Open Demat & Trading Account via Paytm Money, Easy to Guide Open A free Demat account

Managing investments in today’s digital age has become easier and more convenient than ever. One crucial tool that has revolutionized the investment landscape is the demat account. But what exactly is a demat account, and what benefits does it offer? Let’s dive in and explore.

Table of Contents

- Understanding Demat and Trading Account

- Benefits of a Demat Account

- Documents required for opening a Demat and Trading account

- A step-by-step guide to opening an account on Paytm Money

- FAQs

1. Understanding Demat and Trading Account

A Demat account, short for a dematerialized account, is an electronic account used to hold and store securities in a digital format. It acts as a repository for your shares, bonds, mutual funds, and other securities that you own. The demat account holds these securities in a dematerialized or electronic form, eliminating the need for physical share certificates. It is similar to a bank account where your funds are stored digitally.

A trading account is used for buying and selling securities (stocks, bonds, derivatives, etc.) in the financial markets. It is linked to a bank account to facilitate the transfer of funds for trading purposes. The trading account is managed by a brokerage firm or a stockbroker. When you place buy or sell orders for stocks or other financial instruments, it is executed through your trading account.

In summary, a trading account is used for executing trades, i.e., buying and selling securities, while a Demat account is used for holding and storing the securities you own in an electronic format.

2. Benefits of a Demat Account

A Demat account simplifies investing by eliminating physical documents. It enables digital management of all your securities, saving time and effort. With a few clicks, you can execute transactions, eliminating the need for traditional paper-based processes. Real-time updates on your holdings are provided, allowing effortless monitoring of investment performance. It offers a comprehensive overview of your portfolio’s value, holdings, and transactions.

3. Documents required for opening a Demat and Trading account

To open a demat and trading account, you will need the following documents:

- Identity Proof: PAN Card

- Address Proof: Aadhaar Card

- Bank Proof: Canceled cheque / Last 3 months’ Bank Account Statement / First page of passbook. Note – Bank proof should have Your name, Bank’s IFSC Code

- Income proof (To activate Futures and Options segment): Income Tax Return (ITR) statement/ salary slips for three months/ bank statement for six months/ Demat holding statement, or holding report. This is optional and not mandatory.

4. Step-by-step guide to opening an account on Paytm Money

Here is a detailed step-by-step guide to opening an account on Paytm Money:

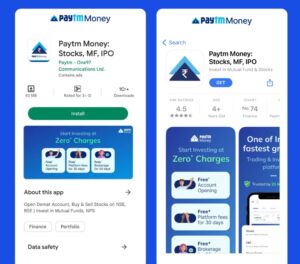

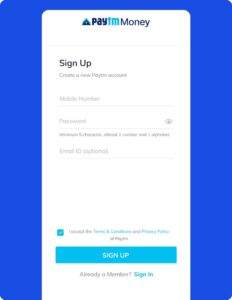

- Download the PaytmMoney application from the Google Play Store or Apple App Store on your mobile phone.

Click on “Open My Free Account” to open your free demat and trading account for the segments – Mutual Funds/Stocks/Future and options.

Enter your PAN number and click on “Proceed” to continue.

- Click on “Proceed for KYC” to fetch the PAN and Aadhaar details from Digilocker.

- Provide consent and click on “Authenticate Aadhaar.”

- Enter your Aadhaar Number and the One Time Password (OTP) received on the mobile number linked to your Aadhaar.

- Set a 6-digit Digilocker security PIN and continue.

-

- Provide your personal details like Marital status, Profession, and Father’s name.

-

- Take a selfie with the camera of your device.

- Draw your signature with your hands (as per PAN) on a mobile screen, or you can upload a picture of your signature.

- Select your income range and submit Nominee details and declaration.

-

Select your income range and submit Nominee details and declaration.

- Verify your Email ID and Mobile number via OTP.

-

-

- Draw your signature with your hands (as per PAN) on a mobile screen, or you can upload a picture of your signature.

- Select your income range and submit Nominee details and declaration.

-

Select your income range and submit Nominee details and declaration.

- Verify your Email ID and Mobile number via OTP.

-

-

Select your income range and submit Nominee details and declaration.

- Select the Future and Options segment and upload proof of income* if you want to activate F&O Trading. (Optional step)

Choose any one of below mentioned valid proof of income* –

- Bank Account Statement/Passbook (Last 6 months)

- Demat Holding Statement (Last month)

- Income Tax Return (Last year)

- Salary Slip (Last month)

- Form 16 (Last year)

- Consolidated Account Statement (Last month)

- EPF/PPF Statement (Last month)

- MF Portfolio (Last month)