Unlocking Global Financial Freedom with Niyo Global Savings Account

Iin the dynamic world of global finance, the Niyo Global Savings Account emerges as a groundbreaking solution, offering not only a seamless account opening process but also a host of exclusive benefits. Let’s explore how you can open a Niyo Global Savings Account and leverage its unique features.

1. Opening a Niyo Global Savings Account: A Simple Guide

Embarking on your Niyo Global journey is quick and straightforward. Follow these steps to open your account:

a. Download the Niyo App: Start by downloading the Niyo app from your preferred app store.

b. Fill in Your Details: Input your personal details as prompted, ensuring accuracy for a smooth account opening process.

c. Verify Your Identity: Complete the necessary identity verification steps to secure your account.

d. Fund Your Account: Once verified, fund your Niyo Global Savings Account to activate it for international transactions.

e. Start Exploring: With your account active, you’re ready to explore the world of benefits that Niyo Global has to offer.

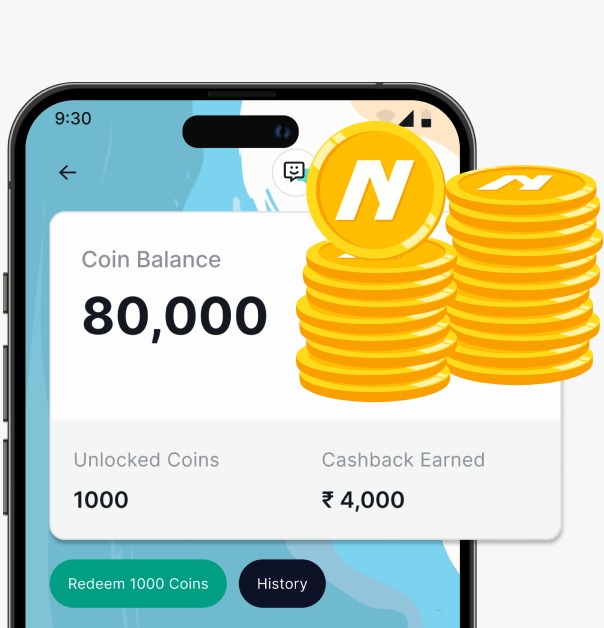

2. Benefits of Niyo Global Savings Account

a. Zero Forex Markup

Say goodbye to hefty forex charges. Niyo Global brings you the advantage of zero forex markup, ensuring that you get the best exchange rates without any additional fees.

b. International Airport Lounge Access

As a Niyo Global Savings Account holder, enjoy the privilege of international airport lounge access. Relax and unwind before your flight, courtesy of Niyo.

c. Earn Up to 6.75% on International Transactions

Niyo Global believes in rewarding your international spending. Earn up to 6.75% on your international transactions, adding value to every purchase made with your Niyo card.

d. Up to ₹25 Lakh Credit Limit

Niyo Global goes beyond traditional banking limits. With a credit limit of up to ₹25 lakh, you have the financial flexibility to meet your international expenses seamlessly.

Conclusion: Niyo Global – Your Gateway to Global Banking

In conclusion, opening a Niyo Global Savings Account not only provides you with a secure and digital banking experience but also unlocks a world of exclusive benefits. From zero forex markup to international lounge access and lucrative credit limits, Niyo Global is your gateway to a borderless financial journey.

Experience the freedom of global banking with Niyo Global, where every transaction is an opportunity to explore.

Frequently Asked Questions

How long does it take to open a Niyo Global Savings Account?

The account opening process is designed for efficiency, allowing you to complete it quickly through the Niyo app.

Is there a fee for forex transactions with Niyo Global?

No, Niyo Global offers zero forex markup, ensuring you get the best exchange rates without additional charges.

How can I access international airport lounges with Niyo Global?

As a Niyo Global Savings Account holder, you can enjoy international airport lounge access as one of the exclusive benefits.

What is the credit limit offered with Niyo Global?

Niyo Global provides a credit limit of up to ₹25 lakh, offering substantial financial flexibility for international transactions.

Can I use Niyo Global for domestic transactions as well?

While Niyo Global is designed for international transactions, you can use it for domestic transactions as well, enjoying the benefits of zero forex markup.